6 Critical Financial Mistakes Killing Profitable DTC Brands

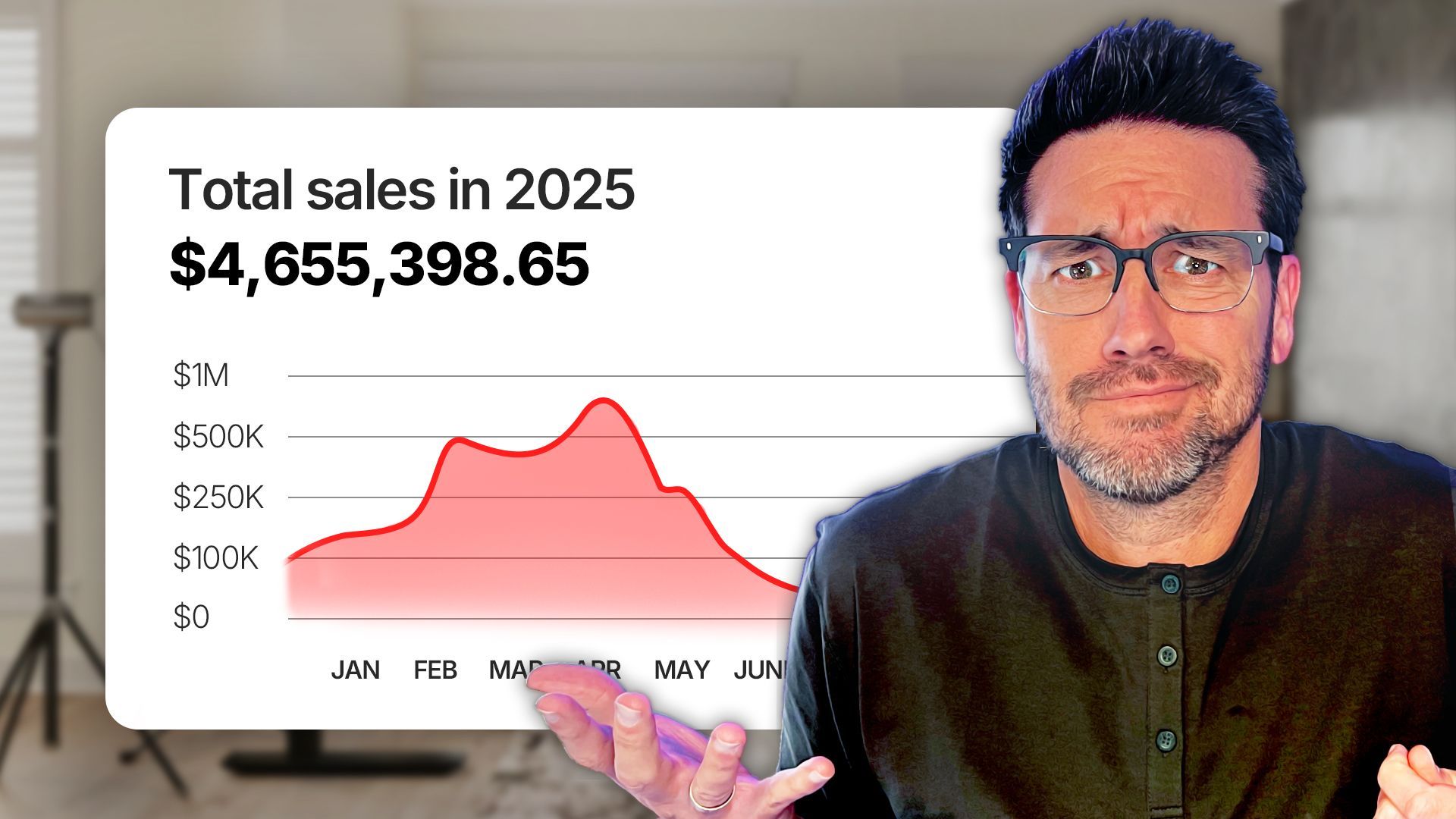

Even if your direct-to-consumer (DTC) brand is generating $100,000 to $300,000 per month in revenue, you could still be on the brink of bankruptcy. As an experienced fractional CFO, I've seen countless DTC companies collapse due to simple financial mistakes.

Your natural instincts and drive got you to this point, but without proper data analysis, bad decisions can lead to devastating consequences. Implement these 6 strategies to avoid common pitfalls and ensure your DTC brand's sustained profitability.

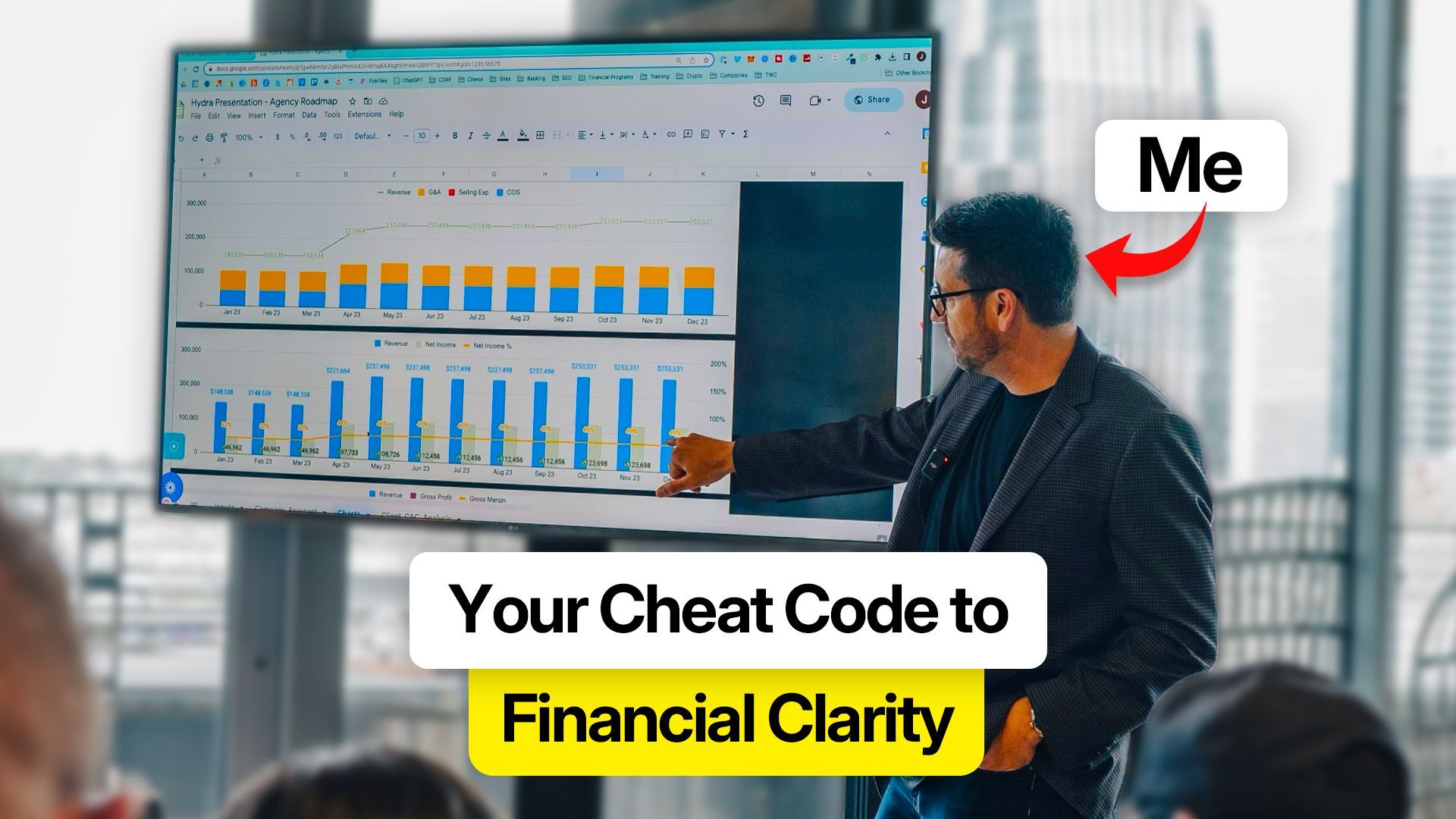

1. Review Financials Regularly

I get it – accounting isn't fun. But your profit and loss statement is the report card for your business health. Are you profitable or failing? Review it monthly to understand performance compared to targets.

Present data visually using graphs and charts to make it digestible. Analyze revenue, expenses, profitability, and cash flow trends. This regular checkpoint ensures you make informed decisions.

2. Use Accrual-Based Accounting

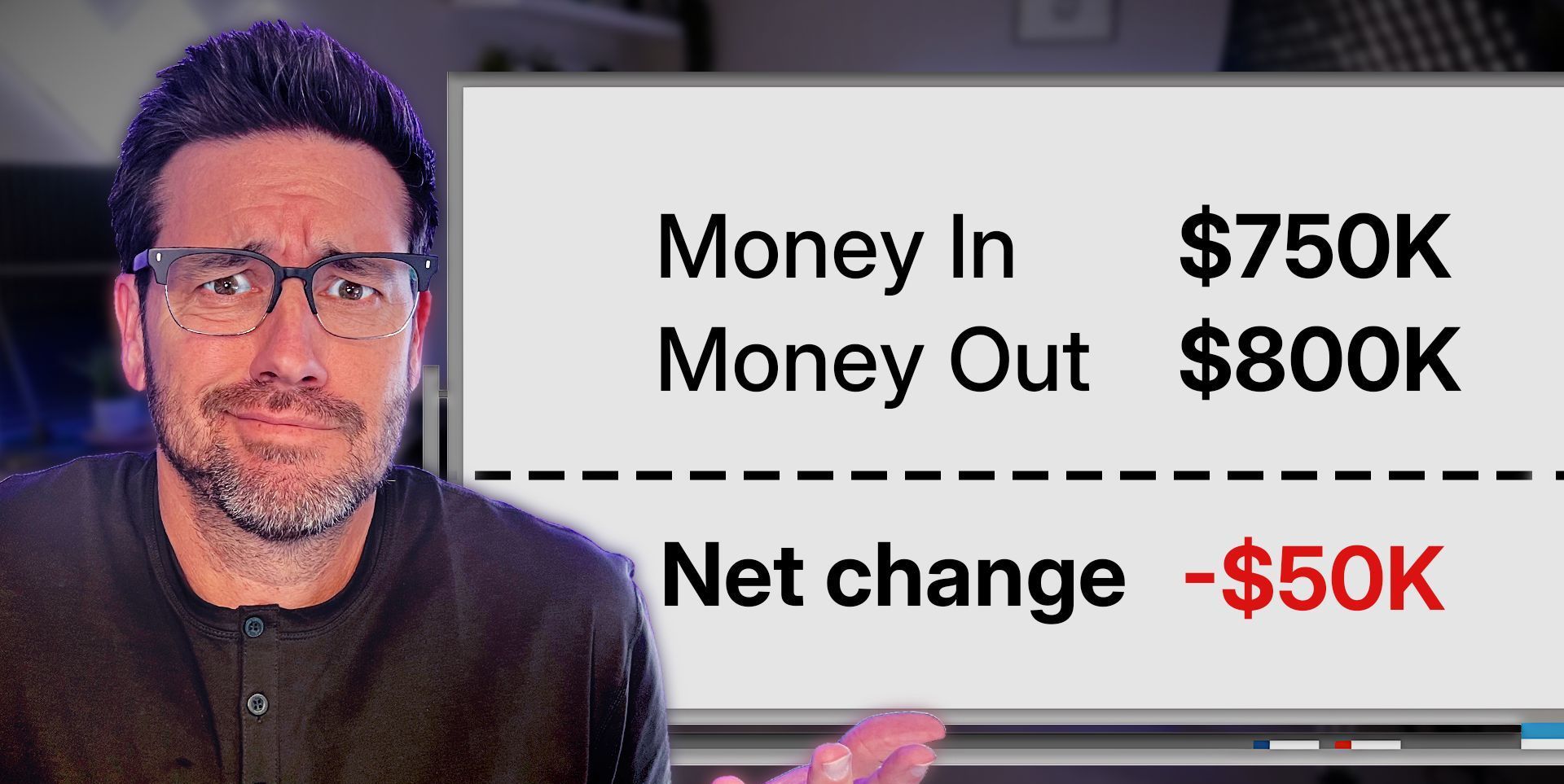

Brands doing millions in revenue often use incorrect cash-basis accounting, distorting margins and profit. With cash accounting, inventory purchases are fully expensed upfront rather than matched to sales.

Accrual accounting aligns inventory costs with revenue, giving accurate gross margins. This clarity empowers you to:

- Understand true profitability and contribution margins

- Optimize ad spend based on customer acquisition costs

- Make data-driven pricing and inventory decisions

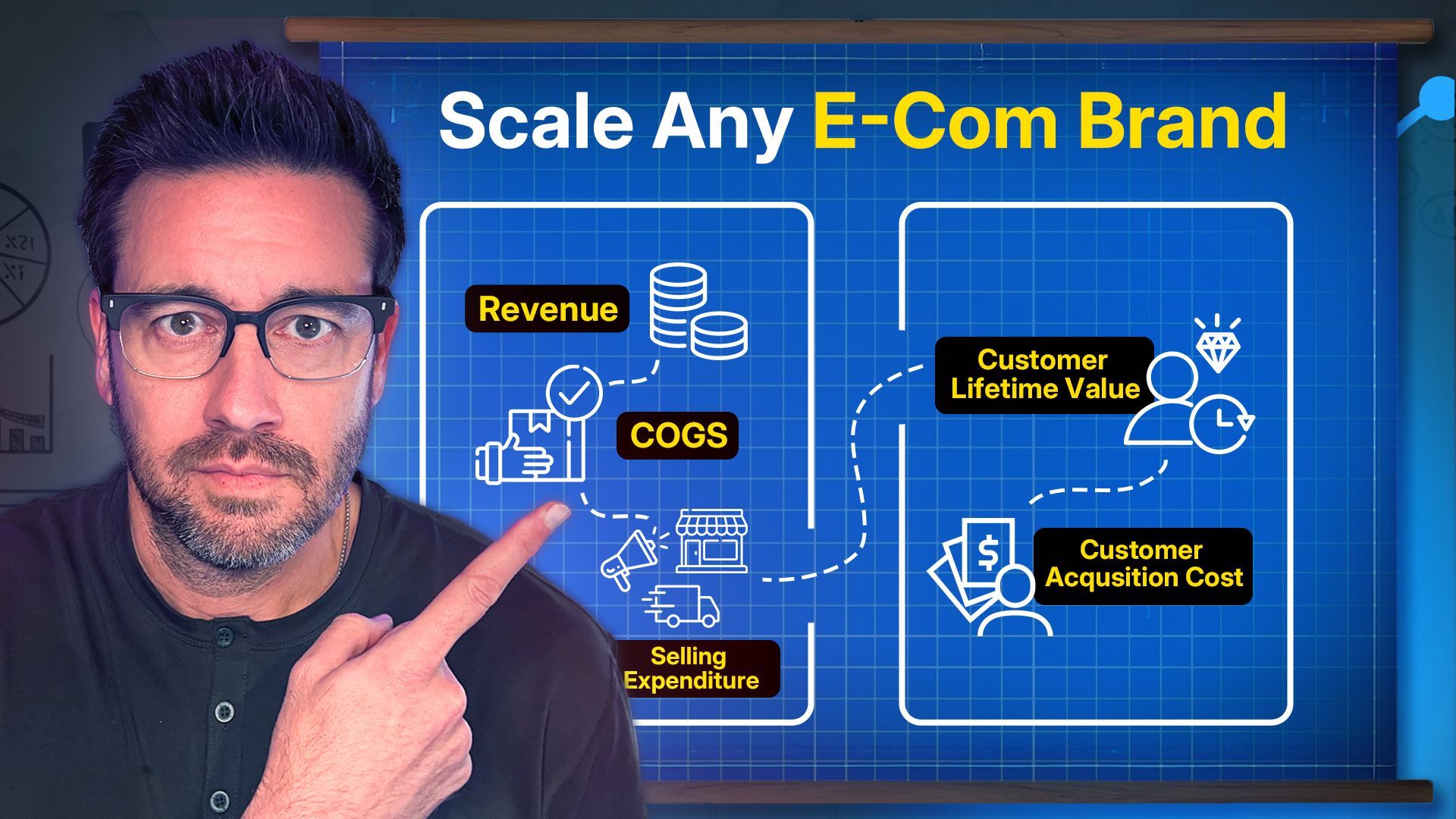

3. Calculate Customer Acquisition Cost

You must know your CAC – the cost to acquire each new customer through marketing. This metric determines if your ad spend is profitable or losing money.

For example, if you spend $50 to acquire a customer with a $80 average order value (AOV), you could be losing money after considering costs like inventory, shipping, and fees.

Set an initial CAC target to break even, then optimize based on customer lifetime value (LTV) data. This strategic spend maximizes growth and profitability.

4. Maximize Your Email Marketing

Don't ignore the power of your email list! At minimum, 30% of DTC revenue should come from email campaigns and nurture sequences. Top brands generate over 50% from their lists.

Understand attribution accurately. Most software gives full credit, but you need historical trends. Optimize automated flows, broadcast emails, and re-engagement tactics to fully capitalize on this revenue channel.

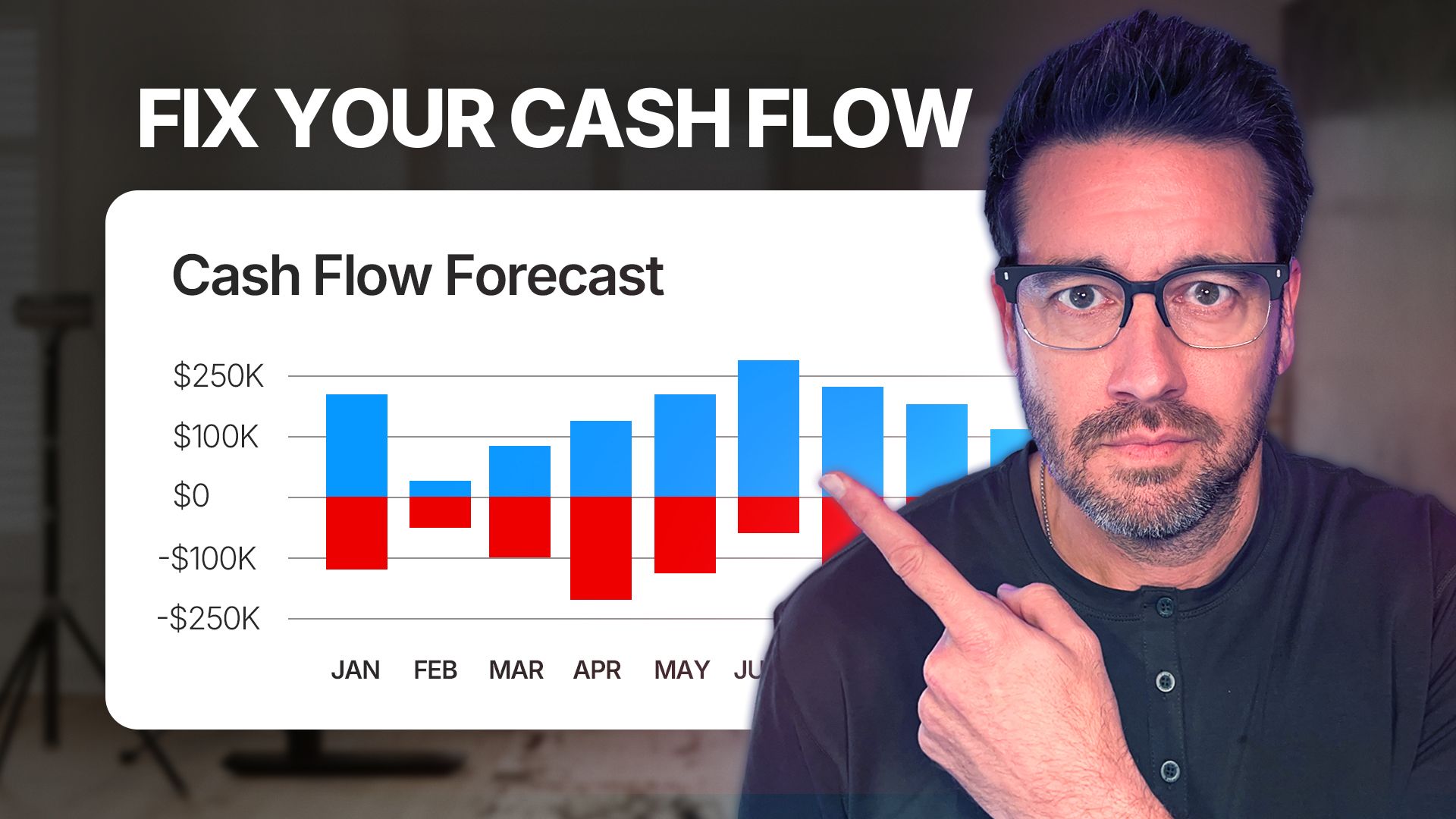

5. Improve Cash Flow Management

Looking at your bank balance isn't enough. Plan for upcoming expenses and sales cycles at least 2-3 months out using:

- Sales demand forecasting to predict inventory needs

- Cash reserves for unexpected events or opportunities

- Lines of credit from banks (not high-cost financing)

Proper cash flow projections prevent you from being blindsided and preserve financial flexibility.

6. Manage Profit Margins Closely

With accurate accrual accounting, you can analyze:

- Gross profit margins (ideally over 80%)

- Shipping costs (target 10-12%)

- Transaction fees (typically 3%)

Monitor these percentages and plugging any leaks. Negotiate better supplier costs, adjust pricing, or streamline operations to improve margins and maintain profitability.

Frequently Asked Questions

What is a reasonable profit margin for DTC brands?

For DTC brands, a gross profit margin over 80% is ideal after accounting for costs of goods sold (COGS). This leaves room for marketing, overhead, and still achieving healthy net profits.

How much revenue should come from email marketing?

At minimum, 30% of monthly DTC revenue should be generated from email marketing campaigns and automated flows. Top DTC brands often see over 50% from their email lists.

How can DTC brands improve cash flow management?

Create cash flow projections 2-3 months out based on demand forecasting. Maintain cash reserves and secure low-cost lines of credit from banks to provide flexibility.

Optimize Your DTC Finances Today

Avoiding these critical mistakes can mean the difference between a thriving, scalable DTC brand and falling victim to bankruptcy. Implement strategic financial practices like:

- Reviewing KPI dashboards regularly

- Calculating accurate contribution margins

- Managing cash flow proactively

- Maximizing high-value channels like email

A fractional CFO provides specialized expertise to maintain a solid financial foundation for DTC growth. Proper data and strategy empower you to make informed decisions and achieve profitability.

See It In Action

Want to go deeper into these financial strategies? Watch this video from a fractional CFO outlining 6 critical mistakes killing profitable DTC brands: