Mastering the Financial Foundation

As a fractional CFO specializing in direct-to-consumer (DTC) brands, I can't stress enough the importance of having a rock-solid financial foundation. Without a firm grasp on your profit margins, customer acquisition costs, and other key metrics, you'll be flying blind as you attempt to scale.

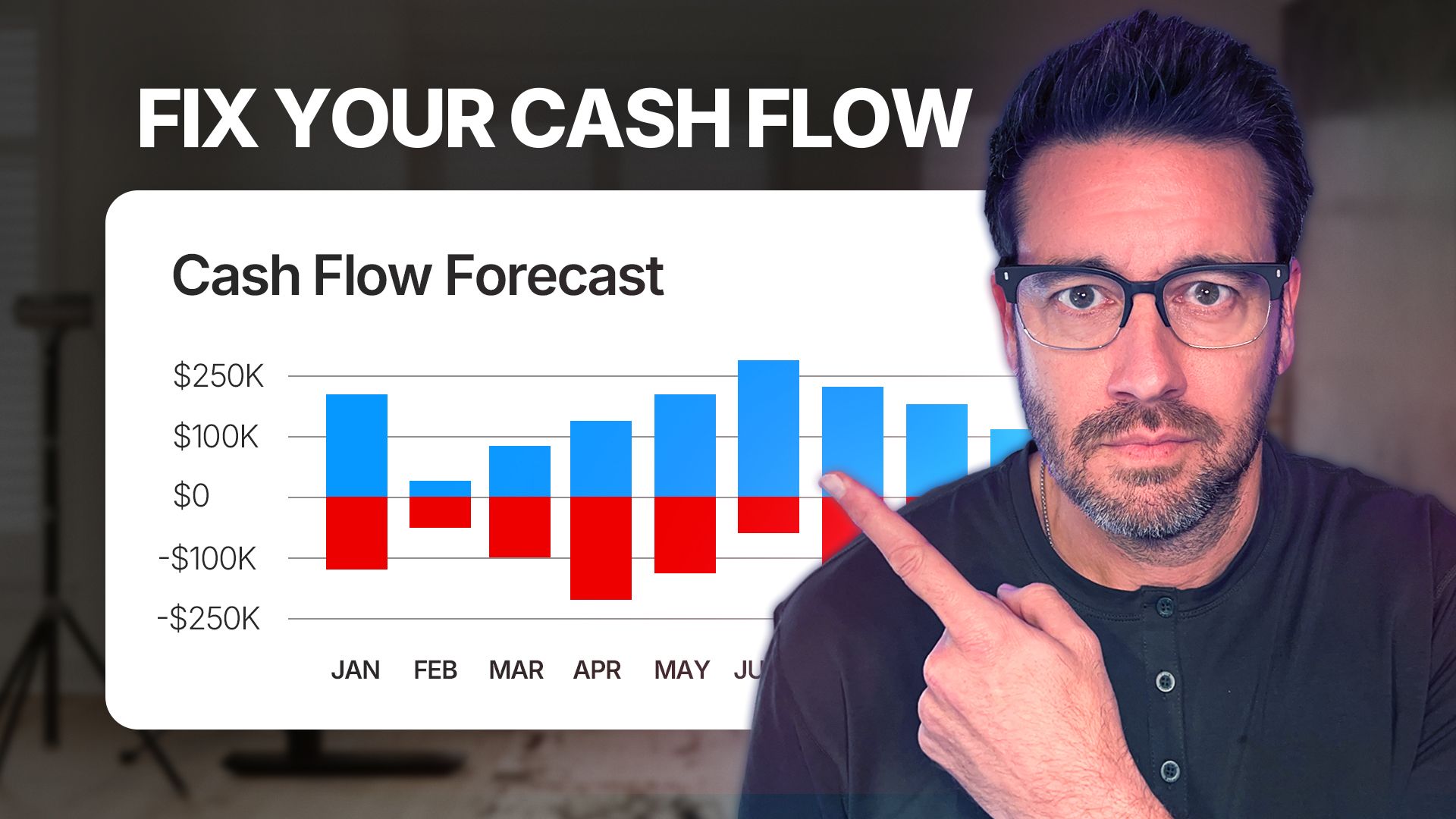

At its core, your financial foundation boils down to understanding a few critical numbers:

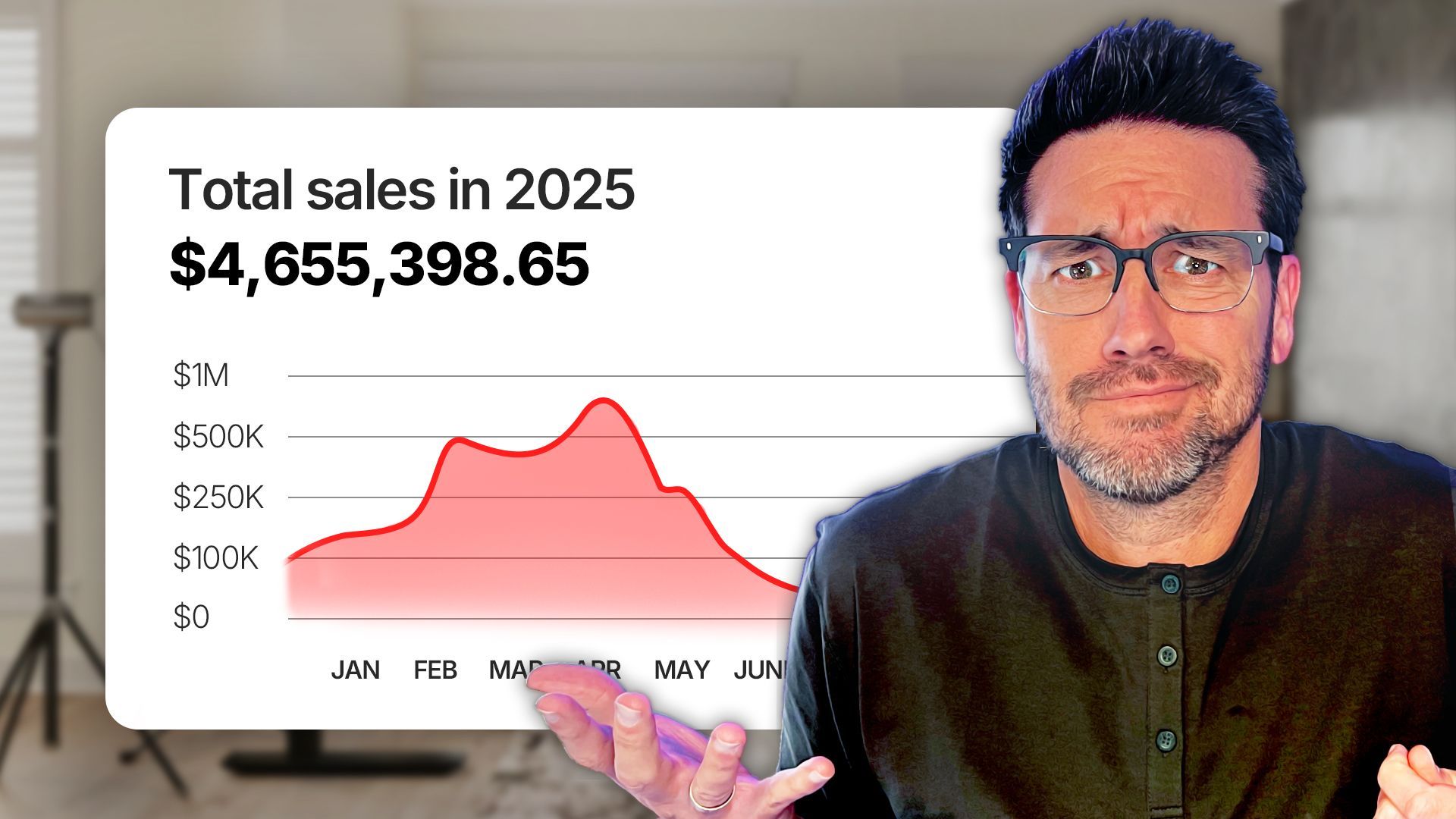

- Revenue: The total sales coming into your business

- Cost of Goods Sold (COGS): The actual cost of your products (aim for 20% of revenue or better)

- Gross Profit: Revenue minus COGS, representing funds available for other expenses

- Marketing/Advertising Spend: Your customer acquisition costs (target 30-40% of revenue)

- Shipping Costs: Should be 10-12% of revenue for U.S.-based DTC brands

- Payment Processing Fees: Typically 3-4% of revenue

- Overhead: Fixed costs like rent, payroll, software, etc. (keep as lean as possible)

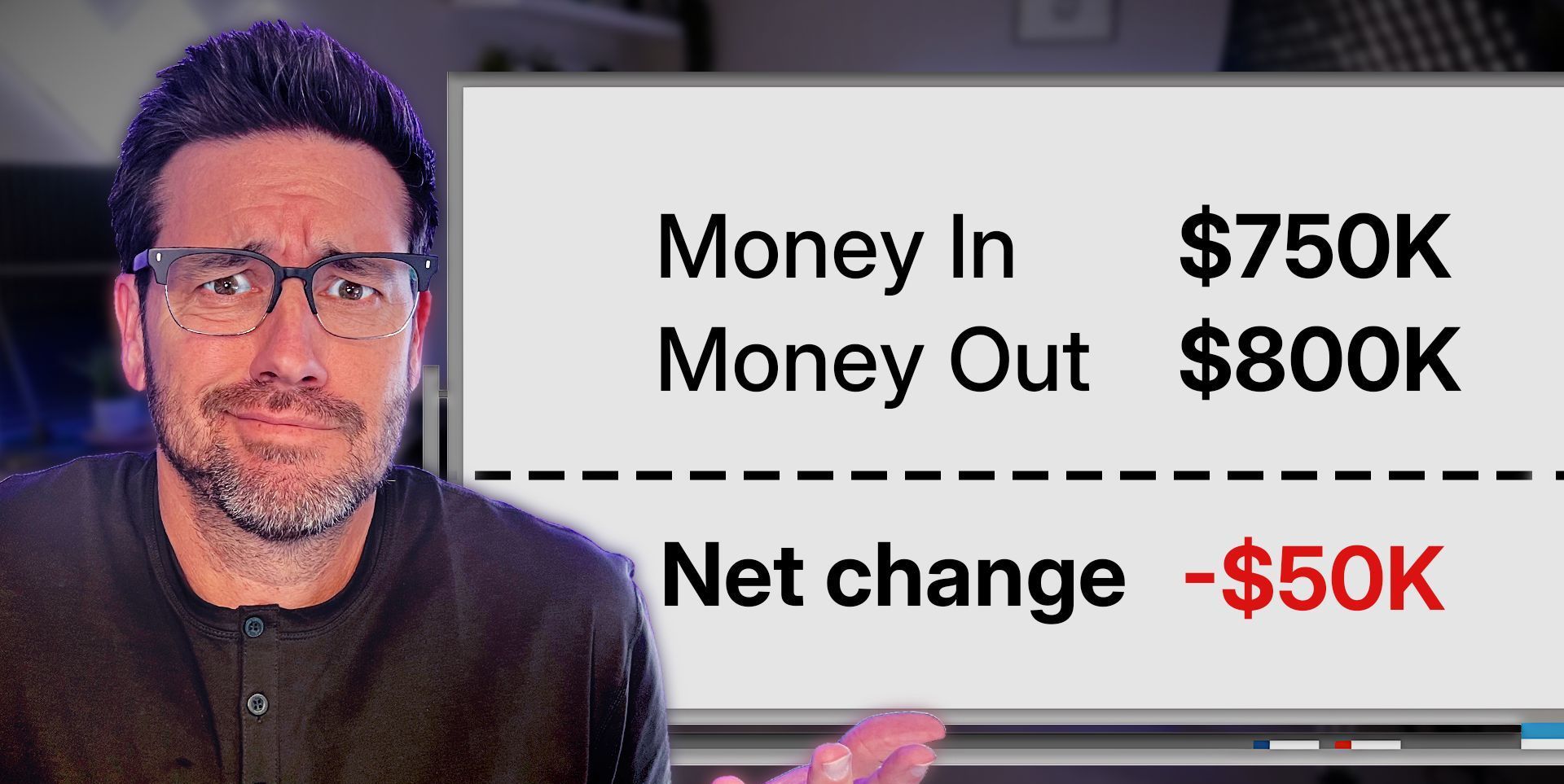

With these core numbers in place, you can calculate your net operating income – the true profitability of your business. Most successful DTC brands target at least 10% net profit margins as they scale.

Leveraging Customer Lifetime Value (LTV)

While understanding your financial foundation is critical, the real key to accelerated growth lies in your customer lifetime value (LTV) and how it interacts with your customer acquisition costs (CAC).

Customer lifetime value represents the total revenue a customer will generate for your brand over the lifetime of their relationship with you. For DTC brands, this number ideally increases over time as customers make repeat purchases.

Let's look at a simple example:

- You spend $35 to acquire a new customer

- Their first purchase is $50 (your average order value or AOV)

- After expenses like COGS, shipping, and processing fees, you lose money on that first transaction

- But if that customer's LTV grows to $150 over 12 months through repeat purchases, you'll recoup your upfront investment and be profitable in the long run

The higher your customer LTV, and the faster it compounds, the more you can afford to invest in acquisition upfront – allowing you to rapidly scale your sales and market share.

Striking the Right CAC Balance

With customer LTV projections in hand, you can calculate the ideal customer acquisition cost that will allow you to hit profitability within an acceptable timeframe based on your available capital and inventory levels.

For example, if your contribution margins and LTV indicate you'll be profitable in 4 months at a $45 CAC, you can ramp up ad spend to attract more buyers at that threshold.

But be cautious – if pumping more into ads at that $45 CAC doesn't significantly increase your new customer volume, it may signal ad fatigue or other marketing inefficiencies that need to be addressed.

The brands that can sustain the highest allowable CAC while maintaining strong marketing efficiencies will inevitably win their respective markets. But you have to deeply understand unit economics to strike that ideal balance.

Putting It All Together

Optimizing the pieces of this financial blueprint in unison is what allows the most capital-efficient DTC brands to acquire customers at unprecedented rates:

- Lock in healthy profit margins by negotiating COGS and aligning other core expenses

- Implement systems to maximize customer LTV through retention tactics

- Based on contribution margins and LTV, calculate your allowable CAC levels

- Invest aggressively in acquisition up to that threshold, continuously refining messaging and channels

- Scale rapidly by outspending competitors while still hitting your target payback periods

While this process is simplified here for illustration, it highlights the power of aligning your financial drivers for accelerated, sustainable DTC growth. It's a blueprint I've used to scale brands from $4M to over $40M in annual revenues.

If you're unsure where your DTC brand stands on these fronts or need strategic guidance, I offer fractional CFO services to optimize your financial engine for scaling. Feel free to reach out to discuss an evaluation.

Frequently Asked Questions

What is the financial foundation for scaling a DTC brand?

The financial foundation is understanding your profit margins, customer acquisition costs, customer lifetime value, and other key metrics. Without a solid grasp of these numbers, scaling becomes incredibly difficult.

How can I improve my profit margins?

Analyze your cost of goods sold, explore bundling opportunities, negotiate better supplier rates, and optimize shipping and payment processing fees. Even small improvements to margins can substantially boost profits.

What role does customer lifetime value play in scaling?

Customer lifetime value is critical for determining how aggressively you can invest in customer acquisition. The longer your customers remain profitable, the more you can spend attracting new buyers to rapidly scale.

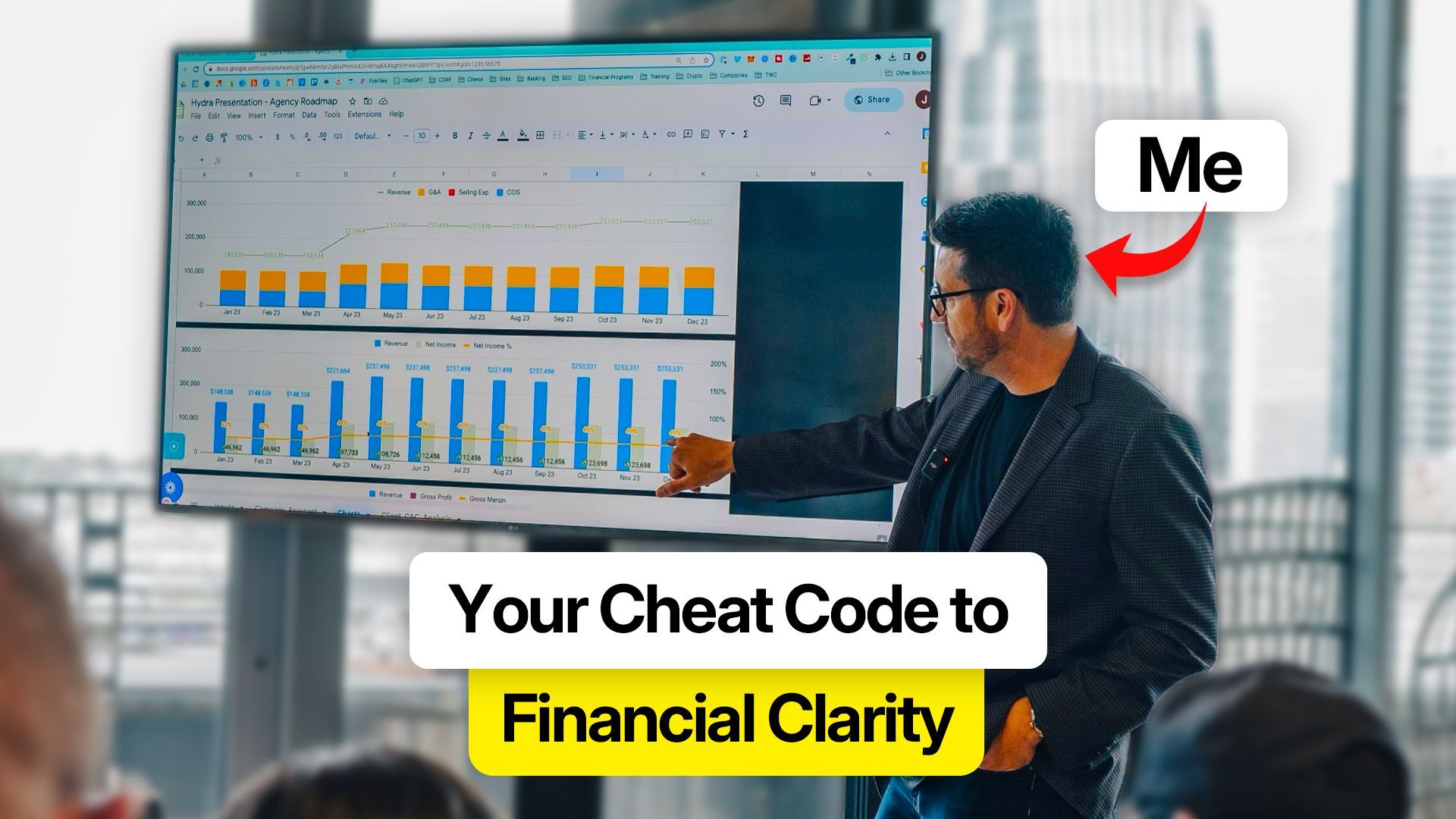

See It in Action

To explore this financial blueprint for DTC brand growth in more depth, I encourage you to watch the video that inspired this post:

YouTube Video: The Blueprint for Growing Your DTC Brand

In the video, I walk through real-world examples and dig deeper into the numbers and strategy. It's a great complement to the written overview provided here.